34+ will i be approved for a mortgage

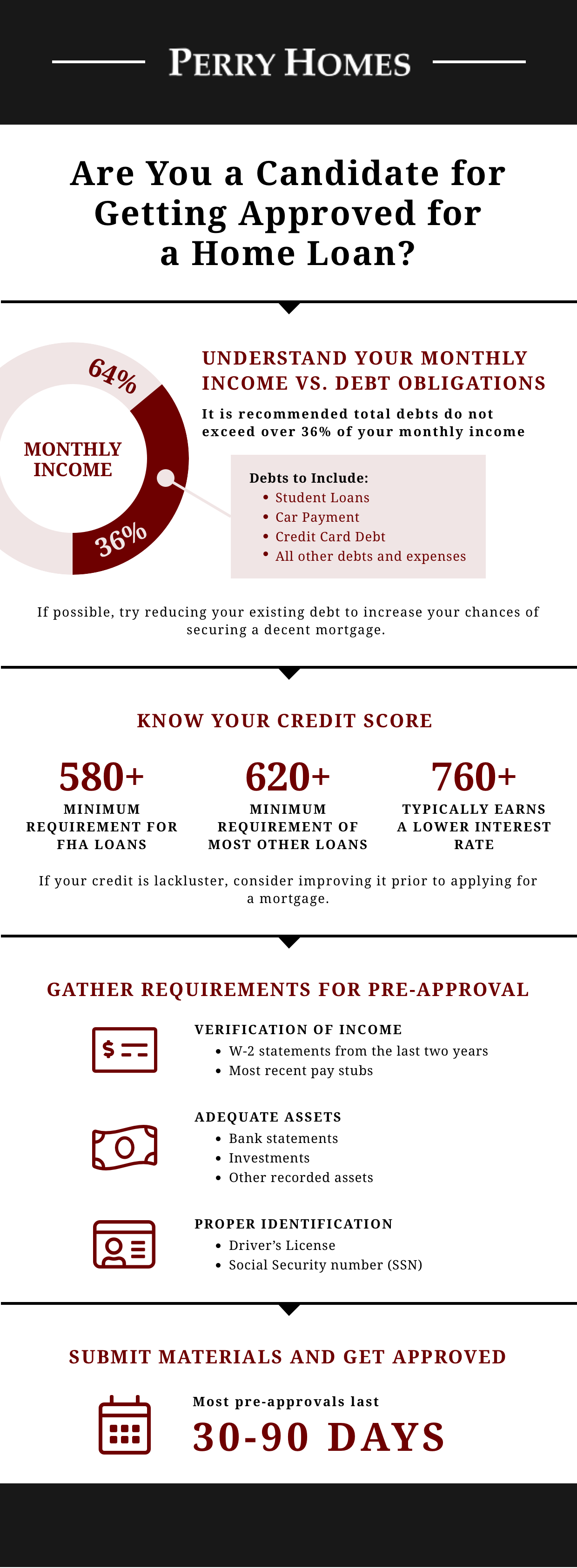

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Some of the most common documents that are required of each borrower include.

How Long Is A Mortgage Pre Approval Good For

Web When you apply for a mortgage checking your credit score is one of the first things most lenders do.

. Web How long does it take for mortgage approval to be approved. This does not mean 294 percent of all the remaining. If youre buying with a partner this is four times youre combined income.

If you qualify for a VA loan or USDA loan though you might get approved with no money down at all. The buyers credit score dropped below the minimum Mortgage pre-approvals are test runs for a buyers actual mortgage approval. Use our required income calculator above to personalize your unique financial situation.

Web To qualify for a conventional loan most lenders require you to have a loan-to-value ratio of no more than 80-95. Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Lenders will want to see proof of income assets and credit history.

Read more about the home appraisal process. Web Some mortgage programs allow as little as 3 down which is 6000 on a 200000 mortgage. W2 statements from the last 2.

The source and amount of funds for your down payment. How much do I need to make for a 400000 house. The higher your score the more likely it is youll be approved for a mortgage and the.

To get preapproved for a mortgage youll need to supply documentation about your income assets and debts. If you and a partner both earned 30000 you could borrow 240000. Web According to Ellie Mae as of July 2017 mortgage lenders approved 706 percent of loan applications started during the previous 90 days.

Web Most home loans require a down payment of at least 3. Web Using the guideline that your home-related expenses shouldnt be more than 28 of your gross income you should try to keep your monthly mortgage payment including property taxes and mortgage. Once your financial information is verified youll have a clear idea of how much home you can afford.

Web Mortgage lenders have a process which may allow you to. Since your cash on hand is 55000 thats less than 20 of the homes price. Web Most borrowers need at least 3-5 down to get approved for a home loan.

These documents typically include the. Were not including any expenses in estimating the income you need for a 500000 home. This breakdown includes the following.

Web One of the main requirements for mortgage pre-approval is being in good financial standing. Web As a general rule the amount you could borrow for a mortgage is around four times your income. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000.

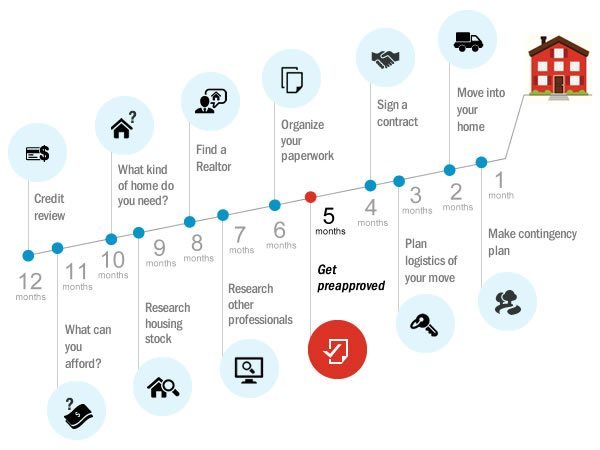

To speed up the home loan pre-approval time you should gather your financial documents that the lender will require eg W2s proof of income tax returns etc. So for example if you earn 30000 a year you could borrow about 120000. A well-crafted financial profile can help.

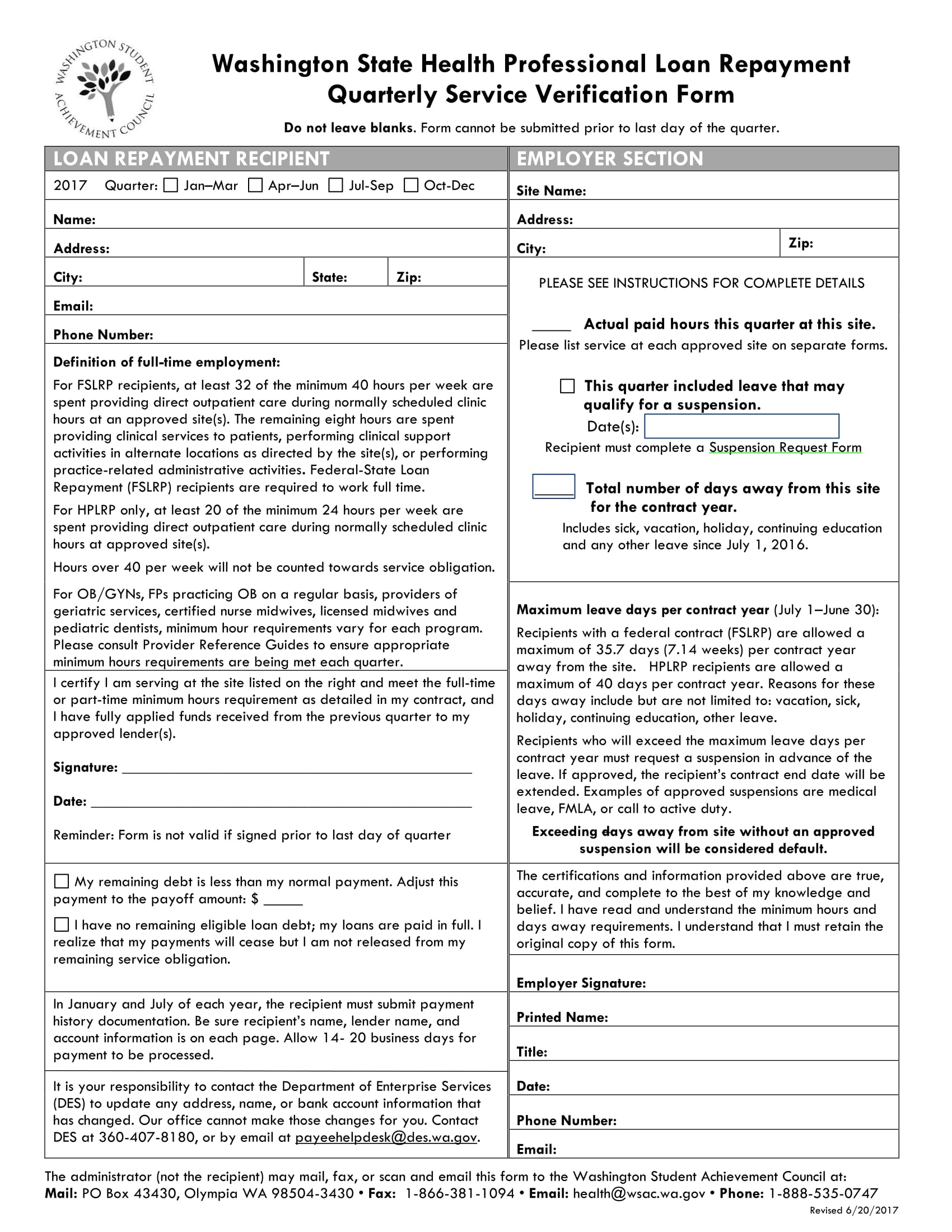

Web Pre-approval requires proof of employment assets income tax returns and a qualifying credit score. Web Steps to help you get approved for a mortgage include getting a cosigner waiting for the economy to improve improving your credit score looking at less expensive properties asking the. But youll avoid private mortgage insurance with a 20 down payment.

Know the maximum amount of a mortgage you could qualify for estimate your mortgage payments lock in an interest rate for 60 to 130 days depending on the lender The mortgage preapproval process may be divided in various steps. This process requires the borrower to provide evidence of their financial health and stability which includes income debts and other factors that lenders use to assess risk. Youll also need to provide identification and verify your employment.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Web A preapproval is a great first step toward buying a home. There are a few common reasons why pre-approvals arent always honored.

Mortgage pre-approval letters are typically valid for 60 to 90 days. Web Prepare a detailed financial profile. Web In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification calculator.

Web Yes a home buyer can get turned down for a mortgage despite getting pre-approved. The higher your homes value and the less you owe on it the lower your LTV. Gather personal and financial documents.

Preparing a detailed financial profile is an important step when applying for a mortgage. On average it takes 7-10 days to get a pre-approval although in some cases it may take less time. You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587.

For Sale 1015 Old Chester Rd Chester Twp Nj 07931 Unreal Estate

Mortgage Preapproval Vs Prequalification How To Get Preapproved

How To Get A Mortgage Loan Without Great Credit

Loraine Woolgar Area Sales Manager Homexpress Mortgage Corp Linkedin

Can I Afford To Buy A Home Mortgage Affordability Calculator

Meredith Spence Mortgage Loan Officer In Boston Ma Embrace Home Loans

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs

Loan Chart Mortgage Mortgage Loans Loan

Steps For Getting Approved For A Home Loan Infographic Perry Homes

How Long Is A Mortgage Preapproval Good For

Can Your Age Affect Your Chances Of Getting Approved For A Mortgage Lavish Green

Northport Me Real Estate Homes For Sale Redfin

34 Flats Without Brokerage For Sale Near Sri Krishna Childrens Hospital Sangareddy Hyderabad

What Is A Loan Verification Purpose Uses

604 Arlington St Morgantown Wv 26501 Mls 10147137 Trulia

7nqaavwfnec9vm

Does Your Age Matter When Getting A Mortgage Mybanktracker